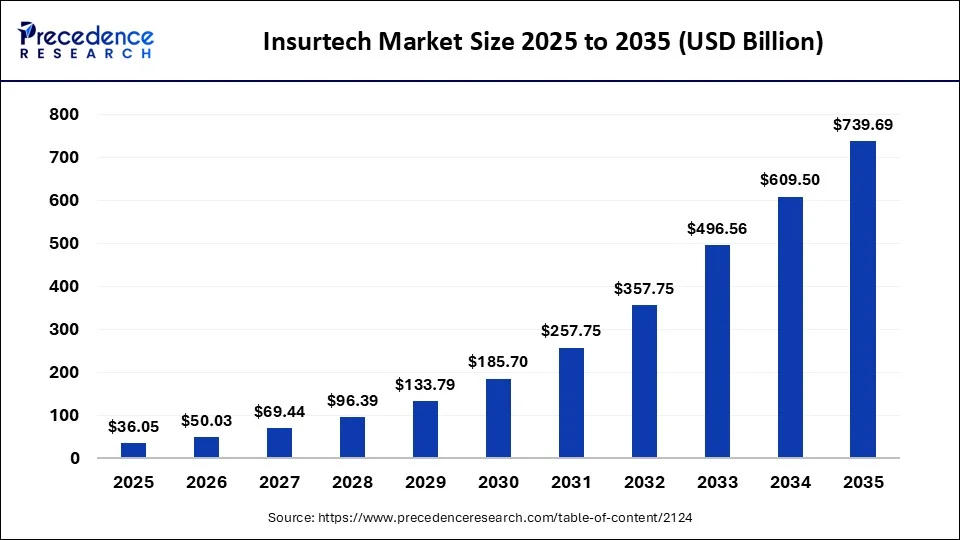

Insurtech Market Size to Surge to USD 739.69 Billion by 2035 as AI-Led Insurance Platforms Scale Worldwide

According to Precedence Research, the global insurtech market size was estimated at USD 36.05 billion in 2025 and is predicted to surpass around USD 739.69 billion by 2035, growing at a CAGR of 35.27% from 2026 to 2035.

Ottawa, Feb. 10, 2026 (GLOBE NEWSWIRE) -- Surging insurance claims are accelerating investments in AI-driven digital infrastructure to boost efficiency and customer experience. Meanwhile, blockchain and crypto adoption are modernizing payments and policy management, fueling Insurtech growth.

What is the Insurtech Market Size in 2026?

The global insurtech market size is evaluated at USD 50.03 billion in 2026 and is anticipated to attain nearly USD 739.69 billion by 2035, with a strong CAGR of 35.27% from 2026 to 2035. The rise in fraud detection and high investment in traditional insurance firms drives market growth.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2124

Insurtech Market Key Highlights

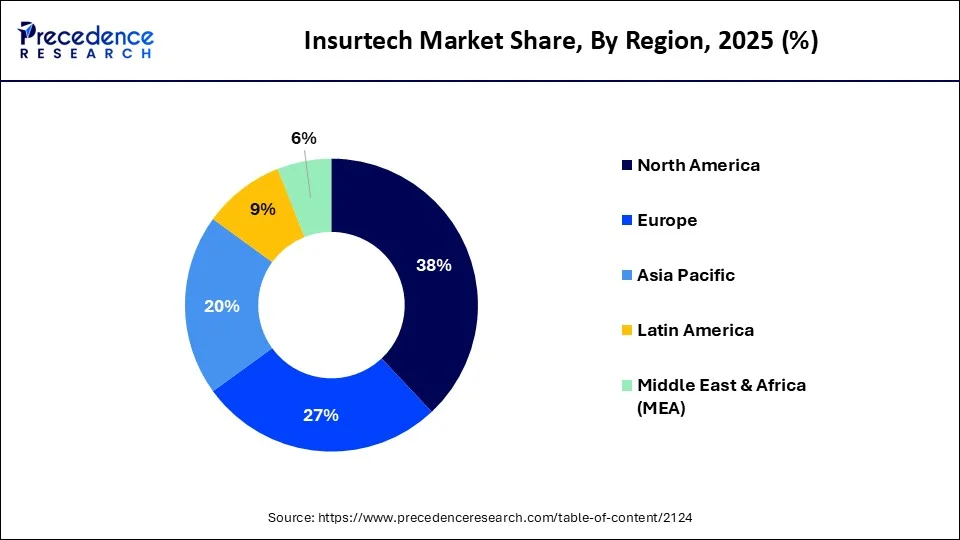

- North America dominated the global insurtech market, accounting for the largest revenue share of 38% in 2025, driven by early technology adoption and a strong digital insurance ecosystem.

- Based on services, the managed services segment emerged as the market leader, capturing 43% of the total market share in 2025, supported by rising demand for scalable and cost-efficient IT operations.

- By type, the health segment generated the highest revenue contribution, holding a 26% market share in 2025, fueled by growing digital health insurance solutions and data-driven underwriting.

- In terms of technology, cloud computing led the market with a 28% share in 2025, owing to its flexibility, security, and ability to support real-time insurance operations.

- By end user, the BFSI segment accounted for the largest revenue share of 22% in 2025, as insurers and financial institutions increasingly invest in digital transformation initiatives.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

What is Insurtech?

Insurtech is the utilization of technology to automate the operation of the traditional insurance industry. It is an abbreviation for insurance technology and uses technologies like IoT, AI, and ML for different purposes. It offers benefits like enhancing operational efficiency, faster claims processing, advanced fraud detection, improving underwriting accuracy, claims personalization, developing innovative products, and risk assessment. The various examples of insurtech are Go Digit Insurance, on-demand insurance, micro-insurance, embedded insurance, usage-based insurance, and others.

The insurtech market growth is driven by the strong focus on enhancing customer experience, increased investment in insurance companies, robust growth of digital infrastructure, strong focus on preventing fraud, increasing need for enhancing underwriting accuracy, popularity of embedded insurance, and the focus on accurate risk assessment.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

Insurtech Market Opportunity

Growing Personalization Demand Unlocks Market Opportunity

The increased consumer demand for tailored insurance policies and the focus on risk assessment on an individual basis increase demand for insurtech. The consumer focus on digital-first experiences and the consumer financial goals increases demand for personalised solutions. The increased utilization of usage-based insurance requires insurtech.

The consumer focuses on increasing satisfaction, and the need for 24/7 availability increases demand for personalization, which requires insurtech. The company's focus on decreasing policy cancellations and providing seamless interactions increases demand for insurtech. The growing personalization creates an opportunity for the growth of the insurtech market.

Get informed with deep-dive intelligence on AI’s market impact https://www.precedenceresearch.com/ai-precedence

Insurtech Market Scope

| Report Metrics | Details |

| Market Size in 2025 | USD 36.05 Billion |

| Market Size in 2026 | USD 50.03 Billion |

| Market Size by 2035 | USD 739.69 Billion |

| Growth Rate (2026 – 2035) | 35.27% CAGR |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Services, Deployment Model, Type, Technology, Application, and End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

➤ Get the Full Report @ https://www.precedenceresearch.com/insurtech-market

Insurtech Regional Insights

Why North America is Dominating the Insurtech Market?

North America dominated the insurtech market with a 38% share in 2025. The well-established financial infrastructure and the increasing use of convenient insurance products increase demand for insurtech. The strong presence of digital infrastructure and the strong consumer focus on personalised insurance increases adoption of insurtech. The presence of companies like Oscar Health, Hippo Insurance, Ethos Life, Kin Insurance, Lemonade, and Root Insurance drives the overall market growth.

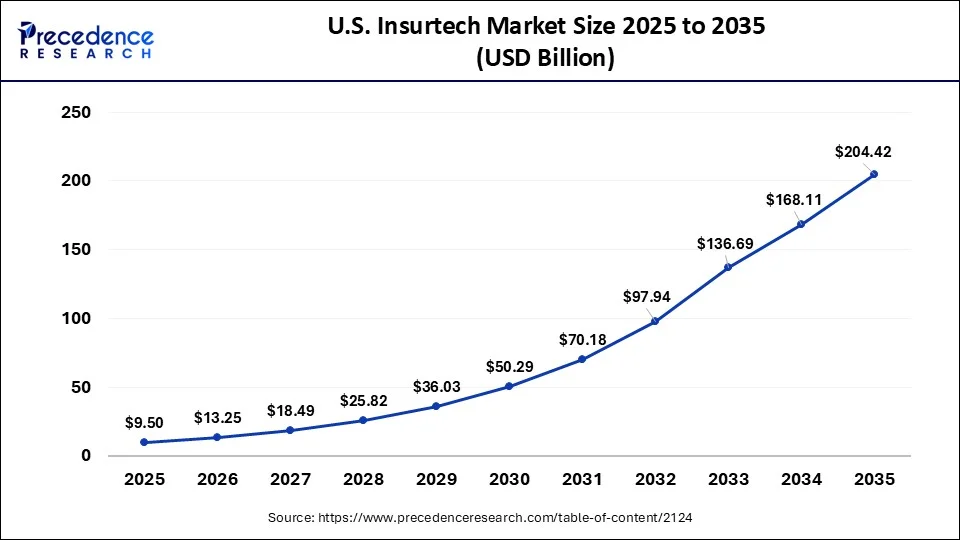

How Big is the Size of the U.S. Insurtech Market in 2026?

According to Precedence Research, the U.S. insurtech market size is expected to be worth around USD 204.42 billion by 2035, increasing from USD 13.25 billion in 2026, with a solid CAGR of 35.92% from 2026 to 2035.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/2124

U.S. Insurtech Market

The U.S. insurtech market is a global leader, driven by advanced digital infrastructure, high insurance penetration, and strong venture capital activity. Insurtech companies in the U.S. focus on leveraging artificial intelligence, big data analytics, IoT, and cloud computing to modernize underwriting, claims management, fraud detection, and customer engagement. The market is characterized by strong collaboration between traditional insurers and technology-driven startups, enabling faster product innovation and personalized insurance offerings. Regulatory support for digital transformation and increasing consumer demand for seamless, on-demand insurance experiences continue to accelerate market growth across life, health, property, and casualty insurance segments.

How is Asia Pacific experiencing the Fastest Growth in the Insurtech Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The robust expansion of smartphone-based insurance platforms and the rise in the integration of insurance in e-commerce increase demand for insurtech. The strong focus on automating claims and the growing demand for health coverage increases adoption of insurtech. The supportive regulations for digital insurance and the transition towards personalised policies support the overall market growth.

India Insurtech Market

The India insurtech market is rapidly evolving, fueled by rising internet penetration, widespread smartphone adoption, and a growing digitally savvy population. Insurtech firms in India are playing a crucial role in expanding insurance access by offering affordable, simplified, and customer-centric solutions, particularly to underserved and first-time buyers. The market emphasizes digital distribution, micro-insurance, AI-based risk assessment, and automated claims processing. Strong government initiatives promoting financial inclusion, along with partnerships between insurers, fintech firms, and technology providers, are driving innovation and scalability, positioning India as one of the fastest-growing insurtech ecosystems globally.

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344

Insurtech Segmental Insights

Services Insights

Why Managed Services Segment Dominates the Insurtech Market?

The managed services segment dominated the insurtech market with a 43% share in 2025. The strong focus on modernizing legacy systems and the growing cyber threats increases demand for managed services. The growing development of personalised insurance products and the popularity of the consumption-based subscription model increase the adoption of managed services. The scalability, 24/7 monitoring, rapid deployment, cost efficiency, and predictability of managed services drive market growth.

Deployment Model Insights

What made Cloud Segment Dominate the Insurtech Industry?

The cloud segment dominated the insurtech industry in 2025. The growing development of digital first product and the strong focus on superior disaster recovery increase demand for cloud. The cost-effectiveness, flexibility, enhanced agility, and improved security of cloud help market expansion. The growing personalised offerings and the strong focus on providing better customer services require cloud, supporting the overall market growth.

Type Insights

How did the Health Fragment Segment hold the Largest Share in the Insurtech Industry?

The health fragment segment held the largest revenue share of 26% in the insurtech industry in 2025. The transition towards proactive care and the increased utilization of wearable devices increase demand for insurtech. The growing healthcare expenditure and the higher need for personalised health plans increase the adoption of insurtech. The robust growth in digital health services and the growing health insurance penetration drive the market growth.

Technology Insights

Why Cloud Computing Segment Dominating the Insurtech Market?

The cloud computing segment dominated the insurtech market with a 28% share in 2025. The strong focus on risk management in insurance and the higher need for enhancing financial efficiency increase demand for cloud computing. The need for disaster recovery and the development of new digital services requires cloud computing. The unmatched scalability, faster speed, enhanced data security, and improved integration of cloud computing support the overall market growth.

Application Insights

How Product Development and the Underwriting Segment Dominated the Insurtech Industry?

The product development and underwriting segment dominated the insurtech industry in 2025. The strong focus on providing 24/7 customer support and the development of usage-based insurance increase demand for insurtech. The focus on lowering fraud and the increasing use of proactive risk assessment requires insurtech. The increased automation of document review and the development of parametric insurance support the market growth.

End User Insights

Which End User held the Largest Share in the Insurtech Industry?

The BFSI segment held the largest revenue share of 22% in the insurtech industry in 2025. The increased use of cyber insurance in the BFSI sector and the need for automating complex processes increase demand for insurtech. The explosion of digital payments and the focus on improving fraud detection require Insurtech. The high amount of data generation in the BFSI industry and the focus on avoiding financial losses drive the overall market growth.

✚ Related Topics You May Find Useful:

➡️ Artificial Intelligence in Insurance Market: Explore how AI is transforming underwriting, claims processing, and customer personalization

➡️ Healthcare Insurance Market: Examine growth driven by rising medical costs and expanding coverage access worldwide

➡️ Insurance Brokerage Market: Understand how advisory services are evolving with digital platforms and client-centric models

➡️ Generative AI in Insurance Market: Discover the impact of generative AI on risk modeling, automation, and operational efficiency

➡️ Critical Illness Insurance Market: Track demand fueled by health awareness and financial protection planning

➡️ Global Specialty Insurance Market: Explore how emerging risks, customized coverage solutions, and regulatory shifts are reshaping the future of specialty insurance worldwide

➡️ Life Insurance Market: Analyze shifting demographics, long-term security needs, and policy innovation trends

➡️ RegTech Market: See how regulatory technology is modernizing compliance and risk management across finance

➡️ Home Insurance Market: Review market expansion driven by urbanization and rising property protection awareness

➡️ Reinsurance Market: Gain insight into global risk-sharing strategies and capital resilience mechanisms

➡️ Property and Casualty Insurance Market: Understand how climate risk and digital claims systems are reshaping the sector

➡️ Fintech as a Service Market: Explore platform-based innovation enabling scalable financial solutions and embedded services

Competitive Landscape in the Insurtech Market

- Damco Group

- DXC Technology Company

- Insurance Technology Services

- Majesco

- Oscar Insurance

- Quantemplate

- Shift Technology

- Trav, Inc.

- Wipro Limited

- ZhongAn Insurance

Recent Developments

- In February 2026, Insurify launched an industry-first ChatGPT insurance app. The app simplifies insurance discovery and helps in reviewing coverage options. The app can finalize the purchase policy and transforms car insurance shopping experience. (Source:-https://fintech.global)

- In December 2025, Orange Poland collaborated with bolttech to launch a new digital insurance platform, Insure with Orange. The platforms make insurance purchasing convenient and introduce value-added services. The platform provides different coverage options and human assistance. (Source:-https://fintech.global)

- In January 2026, Apollo collaborated with ZenHedge to launch a new parametric Freight Expense Insurance solution. The solution offers services like providing underwriting capability, strategic support, approved coverholder, and market reach. (Source:-https://www.reinsurancene.ws)

Segments Covered in the Report

By Services

- Consulting

- Support & Maintenance

- Managed Services

By Deployment Model

- On-premise

- Cloud

By Type

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

By Technology

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

By Application

- Product Development & Underwriting

- Sales & Marketing

- Policy Admin Collection & Disbursement

- Claims Management

By End User

- Automotive

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Transportation

- Others

By Region

-

North America

- U.S.

- Canada

- Mexico

- Rest of North America

-

South America

- Brazil

- Argentina

- Rest of South America

-

Europe

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

-

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

-

Western Europe

-

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

-

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2124

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Chem and Materials | Towards FnB | Statifacts | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.